Site search:

-

What’s new?

Energy for London Tags

Brent Buildings Camden Carbon Emissions CHP Cities Climate Adaptation Community Heating Community Initiatives Croydon Data DECC Decentralised Energy Distribution ECO Energy Costs Energy Efficiency Enfield FIT Fuel Poverty Funding Green Deal Hackney Haringey Housing Islington Lambeth Library Local Authorities Mayor Newham Ofgem Olympics Photovoltaics Planning RE:FIT RE:NEW Renewable Energy Retrofit Southwark Tower Hamlets Transport Waltham Forest Waste WestminsterEnergy Archives:

- February 2021 (1)

- January 2021 (15)

- December 2020 (15)

- November 2020 (9)

- October 2020 (3)

- August 2020 (5)

- July 2020 (3)

- June 2020 (4)

- April 2020 (10)

- March 2020 (5)

- February 2020 (2)

- January 2020 (3)

- October 2019 (1)

- September 2019 (4)

- August 2019 (2)

- July 2019 (1)

- August 2018 (1)

- November 2016 (8)

- October 2016 (8)

- September 2016 (2)

- August 2016 (8)

- July 2016 (14)

- April 2016 (12)

- March 2016 (16)

- February 2016 (8)

- January 2016 (4)

- December 2015 (1)

- November 2015 (1)

- October 2015 (16)

- September 2015 (3)

- June 2015 (1)

- May 2015 (1)

- April 2015 (1)

- March 2015 (1)

- February 2015 (1)

- January 2015 (1)

- December 2014 (18)

- November 2014 (4)

- August 2014 (8)

- July 2014 (7)

- June 2014 (25)

- May 2014 (8)

- April 2014 (4)

- March 2014 (12)

- February 2014 (7)

- January 2014 (13)

- December 2013 (11)

- November 2013 (15)

- October 2013 (15)

- September 2013 (18)

- August 2013 (5)

- July 2013 (20)

- June 2013 (33)

- May 2013 (8)

- April 2013 (16)

- March 2013 (25)

- February 2013 (14)

- January 2013 (20)

- December 2012 (23)

- November 2012 (23)

- October 2012 (25)

- September 2012 (14)

- July 2012 (12)

- June 2012 (43)

- May 2012 (20)

- April 2012 (8)

- March 2012 (40)

- February 2012 (39)

- January 2012 (40)

- December 2011 (22)

- November 2011 (40)

- October 2011 (33)

- September 2011 (48)

- August 2011 (40)

- July 2011 (58)

- June 2011 (41)

- May 2011 (80)

- April 2011 (38)

- March 2011 (33)

- February 2011 (25)

- January 2011 (24)

- December 2010 (3)

- November 2010 (7)

- October 2010 (6)

- September 2010 (7)

- August 2010 (1)

- July 2010 (2)

- June 2010 (4)

- May 2010 (1)

- March 2010 (3)

- February 2010 (3)

- December 2009 (5)

- November 2009 (2)

- October 2009 (3)

- July 2009 (3)

- June 2009 (1)

- April 2009 (1)

- March 2009 (1)

- February 2009 (1)

- January 2009 (1)

- December 2008 (2)

- October 2008 (1)

- September 2008 (1)

- July 2008 (1)

- March 2008 (2)

- January 2008 (2)

- October 2007 (1)

- September 2007 (3)

- July 2007 (1)

- March 2007 (1)

- February 2007 (3)

- November 2006 (3)

- August 2006 (1)

- February 2006 (1)

- May 2005 (1)

- February 2004 (1)

Tag Archives: Finance

Councils should use bonds to fund green infrastructure projects

28 February 2016: The Independent reports on a further supporter for the use of Green Bonds to help fund green infrastructure.“Councils should use bonds to fund much needed green infrastructure projects such as renewable energy and flood defences, according to the Lord Mayor of London.” Two quick things to note here: first, the Lord Mayor of London is not the Mayor of London – but Leader of the Corporation of the City of London (one of London’s 33 boroughs) – a one year post largely undertaking ceremonial and social duties. Secondly, The Independent is actually quoting a former Lord Mayor – Sir Roger Gifford was appointed that post in 2012-13. The latest incumbent can seen here.

The Independent continues: “Sir Roger Gifford said there was tremendous scope for the country to follow the lead of the US and Swede, where municipalities have raised billions of pounds for green projects by selling bonds to the public. ..The city of Gothenburg launched its own green bond for a project and were flooded with calls from local people wanting to get involved,” said Sir Roger, an experienced financier who heads the UK division of Sweden’s SEB Bank, which managed the Gothenburg green bond. “I don’t see why that shouldn’t happen in Leeds, or Bradford, or wherever.” Gothenburg’s two green bonds have helped fund a number of projects across the city including water, biogas, district heating, and electric vehicle infrastructure.

“Sir Roger added: “There is great potential for the UK to follow the Scandinavian or North America models. Mostly obviously for wind, but also for wave, solar and biofuel power – all those forms of renewable energy are perfect for this kind of climate-friendly financing. Waste management, water management, better water grids, better electricity grids, sustainable transport, sustainable housing – all of them are also excellent, as is air-pollution prevention. His comments came as Swindon became the first council in the UK to issue a solar bond, a renewable energy bond, or a bond of any type to the public for more than a century.”“

Interestingly Sir Roger is also chairman of the recently launched Green Finance Initiative, launched on 16 January of this year “which aims to make London the world leader in green finance” – see full City of London press release here.

Posted in Decentralised Energy, News, Renewable Energy

Tagged City of London, Finance, London Councils

Leave a comment

Tate Awarded first London Energy Efficiency Fund Investment

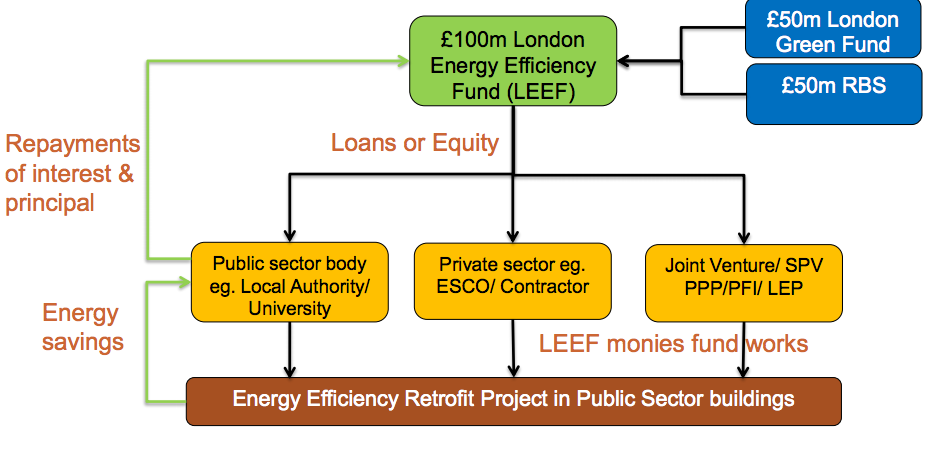

June 2013: A recent question to the Mayor helped highlight the first investment made by the London Energy Efficiency Fund. LEEF was established in November 2011 and has £100m to invest in energy efficiency retrofit to public sector-owned / occupied buildings, and has to be fully invested by December 2015.

The fund is a sub-set of the London Green Fund which is itself made up of £50 million from the European Regional Development Fund (ERDF), £32 million from the London Development Agency (LDA), and £18 million from the London Waste and Recycling Board (LWARB). The European Investment Bank manages the London Green Fund on behalf of the GLA and LWARB. Of the £100 million, £50 million has been allocated to an LEEF which has been match-funded with a further £50m by the Royal Bank of Scotland (RBS). An outline of how the fund operates is set out below.

The Mayor responded to a recent question to state that “Over the past year, the London Energy Efficiency Fund has invested £19.8m in the Tate Modern project that includes a range of innovative energy saving measures, including waste heat recovery from a substation. A number of other projects are currently being considered but are yet to be approved for funding.”

The Mayor responded to a recent question to state that “Over the past year, the London Energy Efficiency Fund has invested £19.8m in the Tate Modern project that includes a range of innovative energy saving measures, including waste heat recovery from a substation. A number of other projects are currently being considered but are yet to be approved for funding.”

The Tate Modern project is the new extension planned for the Bankside gallery – details here – which incorporates a number of innovative energy measures including that it “will draw much of its energy needs from heat emitted by EDF’s transformers in the adjoining operational switch house. With a high thermal mass, frequent use of natural ventilation, and utilisation of daylight, the new building will use 54% less energy and generate 44% less carbon than current building regulations demand.”

Further information is set out in the environmental statement published as part of the Tate’s planning application for the extension here.

Posted in Energy Efficiency, News

Tagged Energy Efficiency, Finance, London Green Fund, Southwark

Leave a comment

London Energy Efficiency Fund – Drop in Session

January 2012: The £100m London Energy Efficiency Fund (LEEF) is a new source of funding for energy efficiency retrofit on public sector buildings in the capital. Following its launch in October 2011, the LEEF team have been holding ‘drop-in’ sessions for potential applicants to discuss the suitability of their project to the fund.

The next session is planned for 10th February 2012 at the offices of Arup at 8 Fitzroy Street, London W1T 4BJ between 12-4pm where “potential project sponsors and other interested parties are welcome to join the LEEF team throughout the afternoon for an informal discussion. There is no set agenda, but we are offering 30 minute appointments in advance for specific queries.”

Further information can be found at www.leef.co.uk

Public-Private Approaches for Energy Efficiency Finance

January 2012: The International Energy Report (IEA) have published a report looking at examples of how public-private opportunities can be used to drive forward energy efficiency investments in the public sector. The report also examines the role of Energy Service Performance Contracts. A few international examples are highlighted – however no reference to London’s RE:FIT programme. The IEA report can be downloaded here.

January 2012: The International Energy Report (IEA) have published a report looking at examples of how public-private opportunities can be used to drive forward energy efficiency investments in the public sector. The report also examines the role of Energy Service Performance Contracts. A few international examples are highlighted – however no reference to London’s RE:FIT programme. The IEA report can be downloaded here.

The Economics of Low Carbon Cities

10 January 2012: This report outlines a new method for a city-scale mini-Stern review evaluating the cost and carbon effectiveness of a wide range of existing low carbon options that could be applied in households, industry, commerce and transport. The research explores the scope for the deployment of these options at the city-scale, along with an analysis of the associated investment needs, financial returns, carbon savings and implications for the economy and employment. Download the report from www.lowcarbonfutures.org. Further information here.

10 January 2012: This report outlines a new method for a city-scale mini-Stern review evaluating the cost and carbon effectiveness of a wide range of existing low carbon options that could be applied in households, industry, commerce and transport. The research explores the scope for the deployment of these options at the city-scale, along with an analysis of the associated investment needs, financial returns, carbon savings and implications for the economy and employment. Download the report from www.lowcarbonfutures.org. Further information here.

Low Carbon Loan Launch

December 2011: Haringey Council will launch the Muswell Hill Low Carbon Loan at on Saturday 3 December 2011. The Low Carbon Loan scheme offer homeowners in the Muswell Hill Low Carbon Zone low interest loans, repayable over 10 – 25 years, to install larger energy saving measures or even a whole house retrofit.

Applicants will receive a free in depth Energy Audit and Retrofit Plan until the end of March 2012. Further information here.

Financing model for energy efficiency retrofits

November 2011: The Local Energy Efficiency Project (LEEP) team, which involves the Energy Saving Trust, have been working with local authorities in the UK on a financing and delivery model for rolling out energy efficiency retrofits designed to work with private sector partners. The aim of LEEP is to create a sustainable and replicable solution that attracts commercial capital at scale for a national domestic eco-refurbishment program delivered through local authorities. A final report has just been produced which summaries the groups findings (scoll to the bottom of the page to find reference to the report).

Supporting Renewable Energy through Business Rates

August 2011: The issue of how the Government’s proposals for business rate retention by local authorities could help fund sustainable energy initiatives has been highlighted previously on this website, and on 18 July, CLG’s consultation paper, Local Government Resource Review: Proposals for Business Rates Retention sets out the detailed proposals for a new rates retention scheme to replace the current local government finance system. Supporting this consultation paper, the Government has now published eight technical papers exploring in further detail how councils would be allowed to keep locally generated business rates, which should help enable them to borrow against future rate income.

In addition to this potential new investment stream into energy projects, included amongst the technical papers is a specific Government’s proposal to support communities hosting renewable energy projects by allowing them to keep the business rates generated from such projects. The paper covers issues such as:

- the types of renewable energy that would be covered by the proposals

- what is meant by a “new renewable energy project”

- how different scenarios of renewable energy projects would be dealt with

- who would be responsible for determining whether a project was covered by the scheme and, therefore, not taken into account in the setting of any levy; and

- how the business rates from a renewable energy project might be split between different authorities in two-tier areas

Posted in News, Renewable Energy

Tagged CLG, Finance, Local Authorities, Renewable Energy

Leave a comment

Cities should be allowed to become more financially independent

23 May 2011: The City Finance Commission have today published the results of their inquiry into the current system of city local government finance recommending that cities should be allowed to become more financially independent, to strengthen their ability to drive both local and national economic growth, deliver localism and to increase care for their communities. Of interest to supporting the development of low carbon solutions, the report proposes that new Tax Increment Financing (TIF) powers for local authorities and Business Improvement Districts should be introduced to support local infrastructure investment.

23 May 2011: The City Finance Commission have today published the results of their inquiry into the current system of city local government finance recommending that cities should be allowed to become more financially independent, to strengthen their ability to drive both local and national economic growth, deliver localism and to increase care for their communities. Of interest to supporting the development of low carbon solutions, the report proposes that new Tax Increment Financing (TIF) powers for local authorities and Business Improvement Districts should be introduced to support local infrastructure investment.

The role of financial services sector in mitigating and adapting to climate change

September 2007: GLA Economics Current Issues Note 19 – this paper examines how London’s financial services sector is helping society mitigate and adapt to climate change. Amongst other things this involves the financing of new environmental technologies; carbon trading; and creating markets, insurance products and other innovative services.